Quarterly Financial Report: October 1 to December 31, 2022

Management statement for the quarter ended December 31, 2022

Download as PDF (669 KB)

1. Introduction

This quarterly financial report should be read in conjunction with the Main Estimates and Supplementary Estimates for fiscal year 2022-2023. It has been prepared by management, as required by section 65.1 of the Financial Administration Act and in the form and manner prescribed by the Treasury Board Directive on Accounting Standards, GC 4400 Departmental Quarterly Financial Report.

This quarterly report has not been subject to an external audit or review.

1.1 Authority and objectives

The Canada School of Public Service (the School) was created on April 1, 2004, when the legislative provisions of Part IV of the Public Service Modernization Act came into effect. The School is a departmental corporation in the Treasury Board portfolio, and its mission is set out in the Canada School of Public Service Act.

A summary description of the School's programs can be found it is 2022-23 Departmental Plan.

1.2 Basis of presentation

This quarterly report has been prepared by management using expenditure-based accounting. The accompanying Statement of Authorities includes the School's spending authorities granted by Parliament, and those used by the department consistent with the Main Estimates and Supplementary Estimates for the 2022-2023 fiscal year. This quarterly report has been prepared using a special purpose financial reporting framework designed to meet financial information needs with respect to the use of spending authorities.

The authority of Parliament is required before money can be spent by the Government. Approvals are given in the form of annually approved limits through appropriation acts, or through legislation in the form of statutory spending authority for specific purposes.

When Parliament is dissolved for the purposes of a general election, section 30 of the Financial Administration Act authorizes the Governor General, under certain conditions, to issue a special warrant authorizing the Government to withdraw funds from the Consolidated Revenue Fund. A special warrant is deemed to be an appropriation for the fiscal year in which it is issued.

The School uses the full accrual method of accounting to prepare and present its annual departmental financial statements, which are part of the departmental results reporting process. However, the spending authorities voted by Parliament remain on an expenditure basis.

1.3 Financial structure

The School has a financial structure comprised of voted budgetary authorities for program expenditures which are paid from the Consolidated Revenue Fund. In addition, the School has statutory authorities for contributions to employee benefit plans and the authority to re-spend revenues.

2. Highlights of the fiscal quarter and fiscal year-to-date (YTD) results

2.1. Total authorities for fiscal year 2022-2023

The authorities available for use in fiscal year 2022-2023 amount to $98.2 million, which comprises $68 million in voted appropriations and $30.2 million in statutory funding. Statutory authorities in fiscal year 2022-2023 consist of $10.9 million forecasted respendable revenue, $10.3 million respendable revenue brought forward from the previous fiscal year under the provisions of section 18(2) of the Canada School of Public Service Act, and $9 million for employee benefit plans.

Total authorities available for use in 2022-2023 increased by $5.1 million or 6% in comparison to the $93.1 million available in fiscal year 2021-2022. The variance is mainly due to the increase of $2.7 million for respendable revenue brought forward from the previous fiscal year, $1.5 million for voted appropriations, $0.7 million for forecasted respendable revenue and $0.2 million for employee benefit plans.

Text version

Total Authorities

| (in thousands of dollars) |

2022-2023 |

2021-2022 |

| Vote 1 - Program expenditures |

67,978 |

66,462 |

| Contributions to employee benefit plans |

8,998 |

8,824 |

| Respendable revenue |

21,225 |

17,773 |

2.2 Planned expenditures for fiscal year 2022-2023

The School has planned expenditures of $98.2 million for fiscal year 2022-2023, consisting of $86.5 million for salaries and benefits and $11.7 million for operating and maintenance. Compared with the same quarter last year, this is an increase of $5.1 million mainly due to:

- Personnel: an increase of $3.8 million mainly attributable to the implementation of retroactive increases for executives and an increase of employees;

- Rental: an increase $3.2 million to reflect yearly expected spending related to software licenses;

Offset by:

- Other subsidies and payments: a decrease of $1.5 million mostly the result of more recoveries from other departments this year compared to last year.

2.3 Expenditures for the quarter ended December 31, 2022

Compared with the same quarter last fiscal year, overall expenditures slightly increased by $0.5 million ($18.3 million versus $17.8 million), which is mainly due:

- Personnel: an increase of $0.8 million mainly attributable to an increase of the salaries of employees and an increase of employees;

- Professional and special services: an increase of $0.5 million mainly attributable to timing differences for payments to Shared Services Canada and to payments for training consultants, IT application consultants and computer services; and

- Acquisition of machinery and equipment: an increase of $0.3 million mainly related to acquisiton of computer equipment and client software.

Partially offset by:

- Other subsidies and payments: a decrease of $1.0 million mainly the result of recoveries from other departments.

2.4 Year-to-Date Expenditures as at December 31, 2022

Compared with year-to-date expenditures from the previous fiscal year, overall expenditures increased by $1.6 million ($58 million versus $56.4 million) which mainly consist of variances associated with:

- Personnel: an increase of $1.4 million mainly attributable to an increase of the salaries of employees and an increase of employees;

- Professional and special services: an increase of $1.1 million mainly attributable to timing differences for payments to Shared Services Canada and to payments for training consultants, IT application consultants and computer services; and

- Acquisition of machinery and equipment: an increase of $1.1 million mainly related to acquisiton of computer equipment and client software.

Partially offset by:

- Other subsidies and payments: a decrease of $1.3 million mainly the result of recoveries from other departments; and

- Rental: a decrease of $0.9 million mainly due to timing differences for the payment of licenses for client software.

3. Risks and uncertainties

The School's ability to meet its goals is dependent on the relevance and quality of its learning products, its technological capability to support access to these products, and its ability to respond to changing priorities and learning needs. The School manages financial resources prudently to be able to meet these challenges.

4. Significant changes in relation to operations, personnel and programs

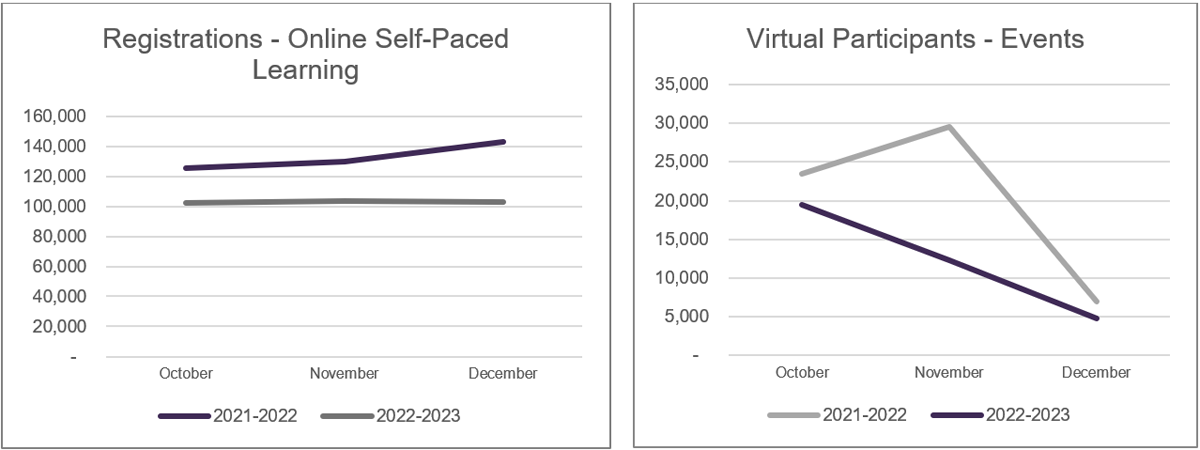

Compared to the same quarter in 2021-2022, registrations for online self-paced learning decreased by 23% to a total of 308,000 in the third quarter and the number of participants for virtual events decreased by 23,000 (-39%), for a total of 37,000 in the third quarter.

Text version

Registrations - Online Self‑Paced Learning 2021-2022 and 2022-2023

| 2021-2022 |

2022-2023 |

| Month |

Registrations - Online Self‑Paced Learning |

Month |

Registrations - Online Self‑Paced Learning |

| October |

125,600 |

October |

102,022 |

| November |

129,986 |

November |

103,603 |

| December |

143,050 |

December |

102,656 |

|

| Total |

398,636 |

Total |

308,281 |

Virtual Participants – Events 2021-2022 and 2022-2023

| 2021-2022 |

2022-2023 |

| Month |

Virtual Participants – Events |

Month |

Virtual Participants – Events |

| October |

23,482 |

October |

19,441 |

| November |

29,535 |

November |

12,277 |

| December |

6,962 |

December |

4,845 |

|

| Total |

59,979 |

Total |

36,563 |

5. Approval by senior officials

Approved by:

(original version signed)

Taki SarantakisPresident

February 27, 2023

Date

(original version signed)

Tom RobertsChief Financial Officer

February 22, 2023

Date

Statement of Authorities (unaudited)

Statement of authorities for fiscal years 2022-2023 in thousands of dollars. Read down the first column for the authorities and then to the right for the figures for the year ending March 31, 2023, the quarter ended December 31, 2022 for fiscal year 2022-2023. The last row of the table displays the total authorities.

| (In thousands of dollars) |

Fiscal year 2022-2023 |

Total available

for use for the year ending

March 31, 2023Note* |

Used during the

quarter ended

December 31, 2022 |

Year to date used

at quarter-end |

| Vote 1 – Program expenditures |

67,978 |

16,042 |

43,618 |

| Budgetary Statutory Authority - Contributions to employee benefit plans |

8,998 |

2,249 |

6,748 |

| Budgetary Statutory Authority - Spending of revenues pursuant to subsection 18(2) of the Canada School of Public Service Act |

21,225 |

- |

7,617 |

|

| Total authorities |

98,201 |

18,291 |

57,983 |

Statement of authorities for fiscal years 2021-2022 in thousands of dollars. Read down the first column for the authorities and then to the right for the figures for the year ending March 31, 2022, the quarter ended December 31, 2021 for fiscal year 2021-2022. The last row of the table displays the total authorities.

| (In thousands of dollars) |

Fiscal year 2021-2022 |

Total available

for use for the year ending

March 31, 2022Note* |

Used during the

quarter ended

December 31, 2021 |

Year to date used

at quarter-end |

| Vote 1 – Program expenditures |

66,462 |

15,563 |

42,138 |

| Budgetary Statutory Authority - Contributions to employee benefit plans |

8,824 |

2,206 |

6,618 |

| Budgetary Statutory Authority - Spending of revenues pursuant to subsection 18(2) of the Canada School of Public Service Act |

17,773 |

- |

- |

|

| Total authorities |

93,059 |

17,769 |

56,373 |

Departmental Budgetary Expenditures by Standard Object (unaudited)

Departmental budgetary expenditures by Standard Object for fiscal years 2022-2023 in thousands of dollars. Read down the first column for the list of expenditures and then read to the right for the figures for the year ending March 31, 2023, the quarter ended December 31, 2022, the year-to-date used at quarter-end. The last row of the table displays the total budgetary expenditures.

| (In thousands of dollars) |

Fiscal year 2022-2023 |

Planned expenditures

for the year ending

March 31, 2023Note* |

Expended during the quarter ended

December 31, 2022 |

Year to date used

at quarter-end |

| Expenditures |

| Personnel |

86,453 |

16,624 |

54,137 |

| Transportation and communications |

929 |

183 |

293 |

| Information |

962 |

164 |

409 |

| Professional and special services |

8,672 |

1,844 |

5,838 |

| Rentals |

6,061 |

1,286 |

2,872 |

| Repair and maintenance |

350 |

2 |

5 |

| Utilities, materials and supplies |

212 |

15 |

35 |

| Acquisition of land, buildings and works |

- |

- |

- |

| Acquisition of machinery and equipment |

1,550 |

485 |

1,361 |

| Other subsidies and payments |

(6,988) |

(2,312) |

(6,967) |

|

| Total budgetary expenditures |

98,201 |

18,291 |

57,983 |

Departmental budgetary expenditures by Standard Object for fiscal years 2021-2022 in thousands of dollars. Read down the first column for the list of expenditures and then read to the right for the figures for the year ending March 31, 2022, the quarter ended December 31, 2021, the year-to-date used at quarter-end. The last row of the table displays the total budgetary expenditures.

| (In thousands of dollars) |

Fiscal year 2021-2022 |

Planned expenditures

for the year ending

March 31, 2022Note* |

Expended during the quarter ended

December 31, 2021 |

Year to date used

at quarter-end |

| Expenditures |

| Personnel |

82,662 |

15,795 |

52,698 |

| Transportation and communications |

643 |

31 |

88 |

| Information |

680 |

73 |

434 |

| Professional and special services |

8,361 |

1,322 |

4,715 |

| Rentals |

2,813 |

1,681 |

3,791 |

| Repair and maintenance |

475 |

25 |

36 |

| Utilities, materials and supplies |

208 |

16 |

38 |

| Acquisition of land, buildings and works |

130 |

- |

- |

| Acquisition of machinery and equipment |

2,575 |

165 |

250 |

| Other subsidies and payments |

(5,488) |

(1,339) |

(5,677) |

|

| Total budgetary expenditures |

93,059 |

17,769 |

56,373 |

- Date modified: